Table of Contents

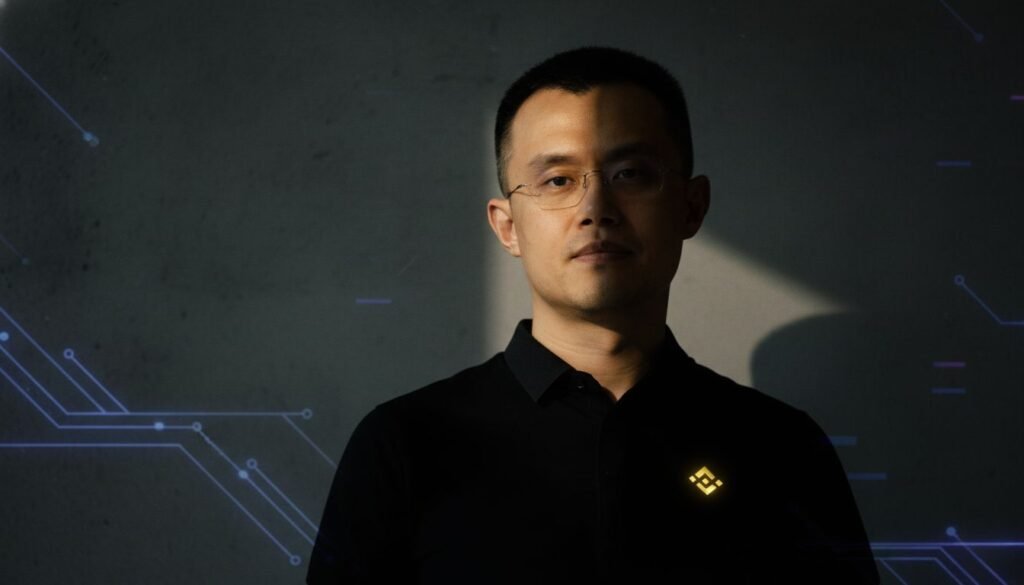

Trump pardons convicted Binance founder Changpeng Zhao in a stunning reversal that underscores how deeply cryptocurrency has embedded itself into American political power. On Tuesday evening, President Donald Trump signed executive clemency for Changpeng Zhao, the billionaire architect of Binance who pleaded guilty to money laundering violations just months ago. The pardon arrives at a moment when digital assets have transformed from regulatory nightmare to political chess piece, and it raises urgent questions about how justice operates when billions of dollars and political influence collide.

1. The Criminal Case Against CZ Was Not Minor

Changpeng Zhao, known universally as CZ in crypto circles, built Binance into the world’s largest cryptocurrency exchange. By 2023, the platform processed trillions in transactions annually. But that scale came with severe regulatory blind spots. Federal prosecutors discovered that Binance had systematically failed to implement anti-money laundering controls, allowing criminal proceeds to flow through its systems. CZ pleaded guilty in November 2023, paid a $50 million fine personally, and Binance itself was hit with a $4.3 billion penalty, one of the largest corporate sanctions in American history.

He served four months in a federal facility before his scheduled release. This wasn’t a technicality or regulatory overreach. Federal investigators found that Binance processed transactions for terrorist organizations, sanctions evaders, and darknet marketplaces. These were knowing failures to stop criminal activity, failures that CZ acknowledged in his guilty plea.

2. Trump Bypassed Every Normal Pardon Process

The pardon announcement came without the usual Justice Department review process. No pardon attorney recommendation. No formal application disclosed to the public. Just a presidential signature and a brief statement praising CZ’s “contributions to financial innovation.” It’s the kind of streamlined clemency that once raised bipartisan alarm, but in 2025, it barely registers as unusual.

Presidential pardon power is nearly absolute. The Constitution grants it with almost no restrictions. But norms matter. For decades, both parties followed an informal process: applications reviewed by career attorneys, consideration of remorse and rehabilitation, input from victims and prosecutors. Trump has systematically dismantled those norms, granting clemency to political allies, business associates, and now, foreign billionaires with useful connections.

3. The Timing Connects Directly to Trump’s Bitcoin Strategy

Trump pardons convicted Binance founder Changpeng Zhao at a moment when cryptocurrency has become central to his political brand. Since returning to office, Trump has positioned himself as the “crypto president,” a dramatic reversal from his earlier skepticism. His family’s business ventures now include digital asset projects. Major crypto executives donated generously to his campaign. The industry has spent over $200 million lobbying Washington in the past two years alone, transforming from regulatory pariah to power broker.

What makes this pardon particularly striking is its timing alongside Trump’s broader cryptocurrency push. The administration has been quietly building what some are calling a strategic bitcoin reserve, exploring ways to integrate digital assets into federal policy. That Trump bitcoin investment strategy for 2025 includes potential partnerships with major exchanges, the very ecosystem CZ dominated.

Pardoning the founder of the world’s largest exchange removes a major regulatory obstacle. It rehabilitates not just CZ personally, but the entire ethos of rapid crypto expansion with minimal government oversight.

4. This Undermines Global Financial Crime Enforcement

Trump pardons convicted Binance founder Changpeng Zhao, and the rest of the world watches carefully. Binance operates globally, with users in virtually every country. Many nations, particularly in Europe and Asia, have taken harder regulatory stances against crypto money laundering. They’ve pressured exchanges to implement strict controls, ban anonymous transactions, and cooperate with law enforcement.

The American president pardoning a convicted money laundering facilitator undermines those efforts entirely. It signals that the United States, long the anchor of global financial regulation, has decided that crypto growth matters more than crypto compliance. Other countries now face a choice: match America’s permissive approach and risk becoming havens for financial crime, or maintain standards and watch capital flee to more accommodating jurisdictions.

China banned cryptocurrency trading years ago, citing financial stability and criminal concerns. The European Union has implemented comprehensive crypto regulation requiring exchanges to verify users and report suspicious activity. If America abandons those standards while simultaneously pardoning those who violated them, we’re not leading the crypto revolution. We’re leading a retreat from accountability.

5. The Message to Other Crypto Executives Is Crystal Clear

This pardon sends an unmistakable signal: if you’re wealthy enough and politically connected enough, criminal convictions for enabling money laundering become negotiable. CZ didn’t just run a poorly monitored platform. Yet here we are. The conviction vanishes. The stigma evaporates. And the message to every other crypto executive watching is clear: build big, move fast, and worry about the legal consequences later. Political influence can clean up the mess.

With his conviction erased, Changpeng Zhao faces no legal barriers to resuming leadership roles in crypto. He cannot currently serve as Binance CEO under the terms of the company’s settlement, but those agreements were negotiated with the prior administration. Expect quiet renegotiation. Expect new ventures, new platforms, new opportunities to shape the industry he defined.

Other crypto executives are taking notes. The lesson isn’t “follow the rules.” The lesson is “build political relationships strong enough that the rules stop mattering.” It’s the same logic driving corporate decisions across sectors, from tech giants replacing workers with automation to financial platforms prioritizing growth over compliance. The Justice Department under Trump has grown noticeably quieter about white-collar prosecutions of cryptocurrency figures. Several high-profile cases have stalled or settled for minimal penalties.

What This Means for Democracy and Rule of Law

When clemency becomes transactional, when it flows toward wealth and power rather than justice and mercy, the entire criminal justice system loses credibility. Why should ordinary Americans respect laws that elites can simply erase through political maneuvering? This isn’t about mercy. It isn’t about justice. It’s about power declaring its own exceptions, writing its own rules, and daring anyone to object.

This is the crypto endgame Trump envisions. Not decentralized resistance to government power, but centralized platforms operating with government blessing in exchange for political loyalty. Not financial revolution, but financial consolidation under friendly management. Not democratic access to wealth, but wealth concentrated among those who can afford influence.

The pardon of Changpeng Zhao is the most honest thing this administration has done. It reveals exactly how the game works now, and who gets to win.