The market had another eventful session with big-name stocks making notable moves. Beyond the headlines, these swings offer some important lessons for investors about how different sectors are being valued in today’s environment.

1. Tech Leadership Is Still Intact

- Intel surged on stronger-than-expected guidance, a sign that chip demand tied to AI and data centers remains robust.

- Nvidia continues to ride the artificial intelligence boom — illustrating how secular growth themes can keep momentum going even in a choppy market.

- Apple was active as investors assess the strength of iPhone demand and supply chain updates. For mega-cap tech in particular, product cycles remain crucial to near-term stock performance.

Investor takeaway: The semiconductor and big-tech rally shows how long-term innovation trends (like AI) can define market leadership. However, investors also need to weigh valuation risks when enthusiasm runs hot.

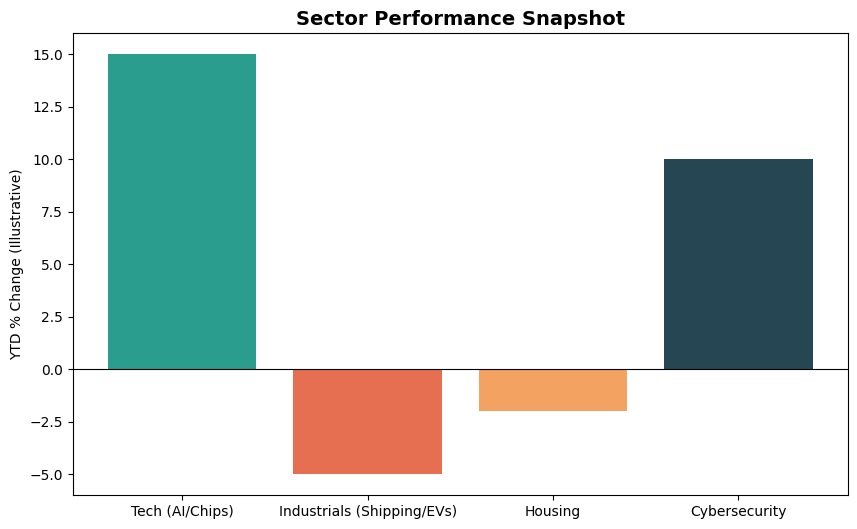

Tech is dominating while industrials and housing lag:

2. Industrial and Consumer Stocks Face Macro Headwinds

- FedEx dropped as concerns over slowing global trade and weaker freight demand resurfaced.

- Tesla continues to experience volatility as investors weigh vehicle delivery expectations, pricing competition, and demand softness.

Investor takeaway: Cyclical industries remain sensitive to broader economic trends. Transport and EV stocks remind us that even innovative businesses can stumble when the macro picture turns cloudy.

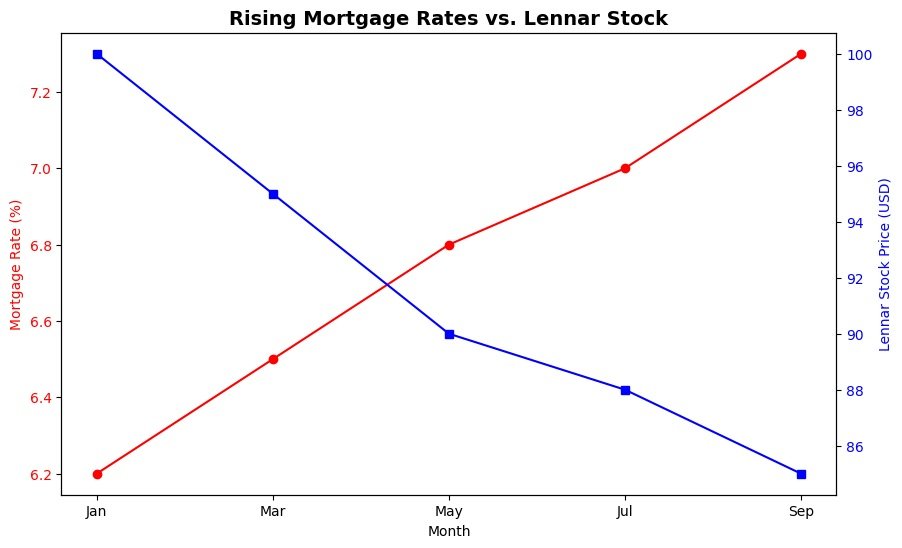

Rising mortgage rates are pressuring housing affordability and builders like Lennar:

3. Housing and Cybersecurity in Focus

- Lennar moved on new housing data, highlighting how rising mortgage rates directly affect affordability and buyer demand.

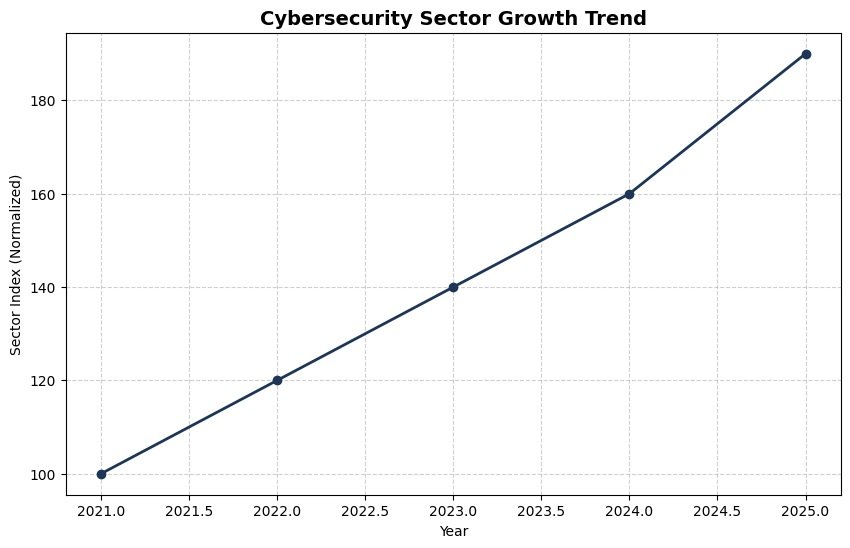

- Netskope, while private, drew attention amid speculation about going public — underscoring continued excitement around cybersecurity as a growth area.

Investor takeaway: Housing stocks can act like a barometer for consumer health, while cybersecurity demonstrates how certain themes (like digital protection) remain in long-term structural growth mode.

Cybersecurity remains a clear structural growth story:

Final Thoughts

What today’s movers show is that markets are being pulled in different directions:

- Tech strength signals resilience in innovation-driven sectors.

- Industrials and discretionary names highlight sensitivity to the macro cycle.

- Housing and cybersecurity provide contrasting signals of cyclical pressure versus secular growth themes.

For investors, the lesson is to balance exposure: participate in growth trends that have staying power (like AI and cybersecurity) but remain cautious in areas where economic headwinds can erode momentum.